Edited by Deepali Verma

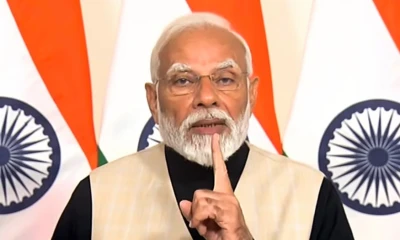

Shortly after Finance Minister Nirmala Sitharaman presented the Union Budget 2024, Prime Minister Narendra Modi praised her team for the interim budget which according to him “reflects the aspirations of young Bharat”.

“This Budget holds the potential to strengthen the foundation for 2047 Viksit Bharat. I congratulate Niramala Sitharaman and her team. The two important decisions in this Budget are for research and innovation that allocates a fund of Rs 1 lakh crore as well as an extension for the tax exemption given to start-ups,” PM Modi said.

“Keeping the fiscal deficit in check, the capital expenditure has been placed at 11.11 lakh crore,” added PM Modi.

Sitharaman’s Budget speech stated that the fiscal deficit has been brought down to 5.8% level. Further, she set an ambitious target to bring down the fiscal deficit at 5.1% of GDP by 2024-25 (FY25) and at 4.5% of the GDP by FY26.

No changes were introduced to income tax slabs which were in line with the expectations. Coming as a relief for the individuals grappling with outstanding tax demands, the government arrived at the decision to withdraw outstanding direct tax demands up to Rs 25,000 for the period up to financial year 2009-10 and up to Rs 10,000 for financial years 2010-11 to 2014-15.

Union Home Minister Amit Shah took to X to call the interim Budget a “roadmap to achieve PM Modi’s vision of a Developed Bharat by 2047”.