The Reserve Bank of India’s monetary policy committee or MPC opted to maintain the key repo rate at 6.5 per cent for the seventh consecutive meeting as a cautious stance amidst persistent pressures of inflation. The decision reflects the RBI’s commitment to achieving its inflation target of 4 per cent, awaiting sustained moderation in inflationary trends.

Emphasising a stance of “withdrawal of accommodation,” the MPC seeks to align inflation with the target while ensuring support for economic growth. Notably, the RBI expects faster growth than previously anticipated, aligning with an upbeat outlook on GDP expansion.

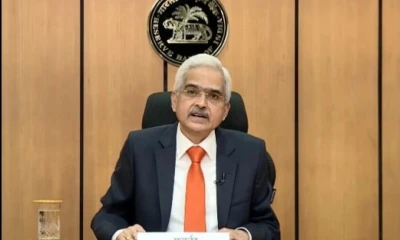

Despite maintaining the repo rate, the RBI retained its headline retail inflation target for FY25 at 4.5per cent, citing inflationary pressures from uncertainties in food prices. Governor Shaktikanta Das reiterated concerns about the inflation trajectory, particularly influenced by food price.

Both the standing deposit facility rate and marginal standing facility rate remained unchanged as the MPC’s cautious approach to monetary policy adjustments.

Regarding economic growth, the RBI upheld its GDP growth estimate for 2024-25 at 7 per cent, in line with earlier projections. Governor Das highlighted the robust expansion in domestic economic activity driven by fixed investment and favourable global conditions.

However, amidst the buoyant growth outlook, economists anticipate the RBI to postpone rate cuts until the latter half of 2024, citing limited scope for immediate easing. The possibility of rate adjustments may emerge in the third quarter of FY25, according to some economists.

The MPC’s decision to maintain the repo rate saw a split among members, with Jayanth R Varma advocating for a 25 basis points reduction in the policy rate and a shift to a neutral stance. Governor Das cautioned against sluggish global trade and inflationary concerns in developed economies’ service sectors, stressing upon the need for prudent risk management.

While acknowledging ongoing efforts in monetary transmission, Governor Das affirmed the RBI’s commitment to flexible liquidity management, reflecting a balanced approach to monetary policy amidst evolving economic conditions.