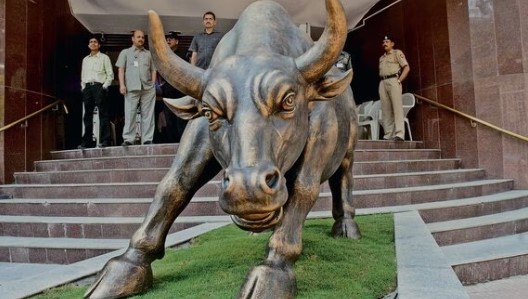

The benchmark Sensex has surged over 5,000 points since the Lok Sabha election results were announced on June 4, driven by a rally in the broader market. On a monthly scale, the 30-share Sensex is up nearly 5 per cent in June. As of 3:15 pm on Thursday, the Sensex extended its rally for the sixth consecutive day, trading at 77,475.08, up 137.48 points (0.18 per cent).

This rally is fuelled by improved investor sentiment, strengthened by expectations of political stability, policy continuity, solid economic growth, a healthy monsoon, and easing inflation.

The volatility in the market around the election results day was triggered by a sharp selloff by foreign institutional investors (FIIs).

According to NSDL data, FPIs sold Indian equities worth ₹25,586 crore in May. However, they invested in Indian debt and debt-VRR instruments during the month, resulting in a net FPI outflow of ₹12,911 crore last month.

The trend has reversed in June, with FPIs investing about ₹12,873 crore in the stock market so far, indicating a positive economic outlook.

The market’s focus is now on the upcoming Budget and policy decisions. Despite potential short-term volatility, experts remain optimistic about the equity market for the medium to long term, given easing inflation, an above-normal monsoon forecast, and prospects of a rate cut cycle by the end of the year.

Concerns persist over the market’s premium valuation. The Sensex is at a record-high level, with no new triggers. Currently, at 23.5, the index’s price-to-earnings ratio (PE) is just slightly below its one-year average PE of 24.

The mid and small-cap segments are even hotter, with many analysts seeing signs of froth. The BSE Smallcap index is up 10 per cent, while the BSE Midcap index has gained over 7 per cent in June so far.

Much will depend on the Union Budget’s details. The government is expected to focus on fiscal consolidation and capital expenditure on infrastructure, construction, and manufacturing schemes, which will boost the economy and generate employment.

The upcoming earnings season and macroeconomic indicators will also be closely observed to determine whether the current market valuation is justified.