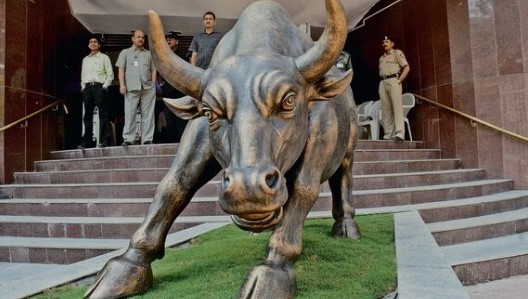

Positive global trends led to a strong close for benchmark stock market indices. The S&P BSE Sensex rose by 126.21 points to finish at 81,867.55, while the NSE Nifty50 increased by 59.75 points, closing at 25,010.90.

Broader market indices, however, faced a decline as smallcap and midcap stocks experienced selling pressure, despite reduced volatility.

Despite this broader market downturn, analysts remain optimistic about sustained gains on Dalal Street, citing strong fundamentals, positive Q1 results, and favourable global cues.

Sectoral indices showed mixed performance with marginal gains in banking, financial services, and energy stocks, but significant losses in realty, IT, and auto sectors.

Top Nifty50 gainers included Power Grid, Coal India, ONGC, HDFC Bank, and Dr Reddy’s. Conversely, M&M, Tata Steel, Hero MotoCorp, Britannia, and Tata Motors were among the top losers.

Geojit Financial Services Research Head Vinod Nair noted, “The benchmarks started positive taking cues from the global market following the Fed Chair’s indication that a rate cut might be considered at the September meeting due to easing inflationary pressures.”

He added, “However, the broader market closed on a negative bias due to escalating geopolitical tensions in the Middle East, leading to rising crude oil prices. Sector-wise, capital goods and realty were impacted by profit-booking, while the auto sector was hit by below-expected monthly sales figures.”

Religare Broking Ltd Research SVP Ajit Mishra commented, “Nifty is now approaching its immediate hurdle at 25,100 and will need fresh triggers to surpass this level. While buoyancy in the global markets, particularly in the US, is encouraging, the underperformance of banking majors is limiting momentum. We continue to advocate a ‘buy on dips’ strategy, emphasising careful stock selection.”